ev tax credit bill point of sale

2023 Honda CR-V Hybrid goes sporty angles for half of sales. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23.

Could New Federal Ev Tax Credit Crater Ev Sales Until End Of The Year Electrek

Theres also a provision to allow buyers to take advantage of the EV tax credit upfront at the point of sale but from our reading of the bill that doesnt seem to go into place until 2024.

. Page 389 line 7. Embedded in the bill is a proposal by Rep. The old credit offered 7500 for new electric vehicle buyers until their automaker hit a 200000 limit for available tax credits.

Moreover theres a new 4000 credit on used electric cars and it seems both the new and used car credits may be available at the point of sale so you might not have to. Credits would be capped to an income level of 150000 for a single filing taxpayer and 300000 for joint filers for new vehicles. Make the 7500 incentive a point-of-sale discount instead of tax credit.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. EVs with battery pack smaller than 40 kWh are limited to a 4000 incentive. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a.

Used vehicle must be at least two model years old at time of sale. Income is capped at 75000 for individuals 112000 for head of household and 150000 for joint filers. While the bill improves the EV tax credit in many ways including making it available at the point of sale and removing the 200k credit cap.

For new EVs a US7500 tax. EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon Half of households might need a costly panel upgrade to use a Level 2 EV charger. The tax credit can be implemented at the point of sale instead of on taxes beginning on January 1 2024.

Currently electric vehicle buyers can qualify for a 7500 tax credit only for manufacturers that have sold fewer than 200000 total EVs. A new 4000 tax credit for the purchase of a used clean vehicle. Biden proposing point-of-sale incentives affordable EVs made in America.

Plug-in hybrid buyers received a smaller credit. President Joe Biden signed Democrats landmark climate change and health care bill into law on Tuesday. Beginning January 1 2024 this incentive becomes available as a point-of-sale rebate.

For five years the legislation would implement 7500 point-of-sale consumer rebates for electric vehicles and pay out an additional. EV tax credit extension with 7500 point-of-sale rebate 4000 for used EVs could pass Senate soon. It includes a tax credit of up to 7500 that could be used to defray the cost of purchasing an electric vehicle.

This effectively makes it a rebate. Used Vehicle Credit. The most important changes for drivers and car companies revolve around the fact that all EVs currently on sale in the US.

For a start as it stands many of the bills EV allocations are expected to come into effect for cars put into service after December 31st 2022 and will stay in place through 2032 according to Consumer Reports. The West Virginia Democrat who previously described. A used EV tax credit begins January 1 with 4000 available for used EVs purchased from a dealer and costing less than 25000.

Before this date it remains a tax credit. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000. Senator Joe Manchin has had a change of heart about electric vehicles.

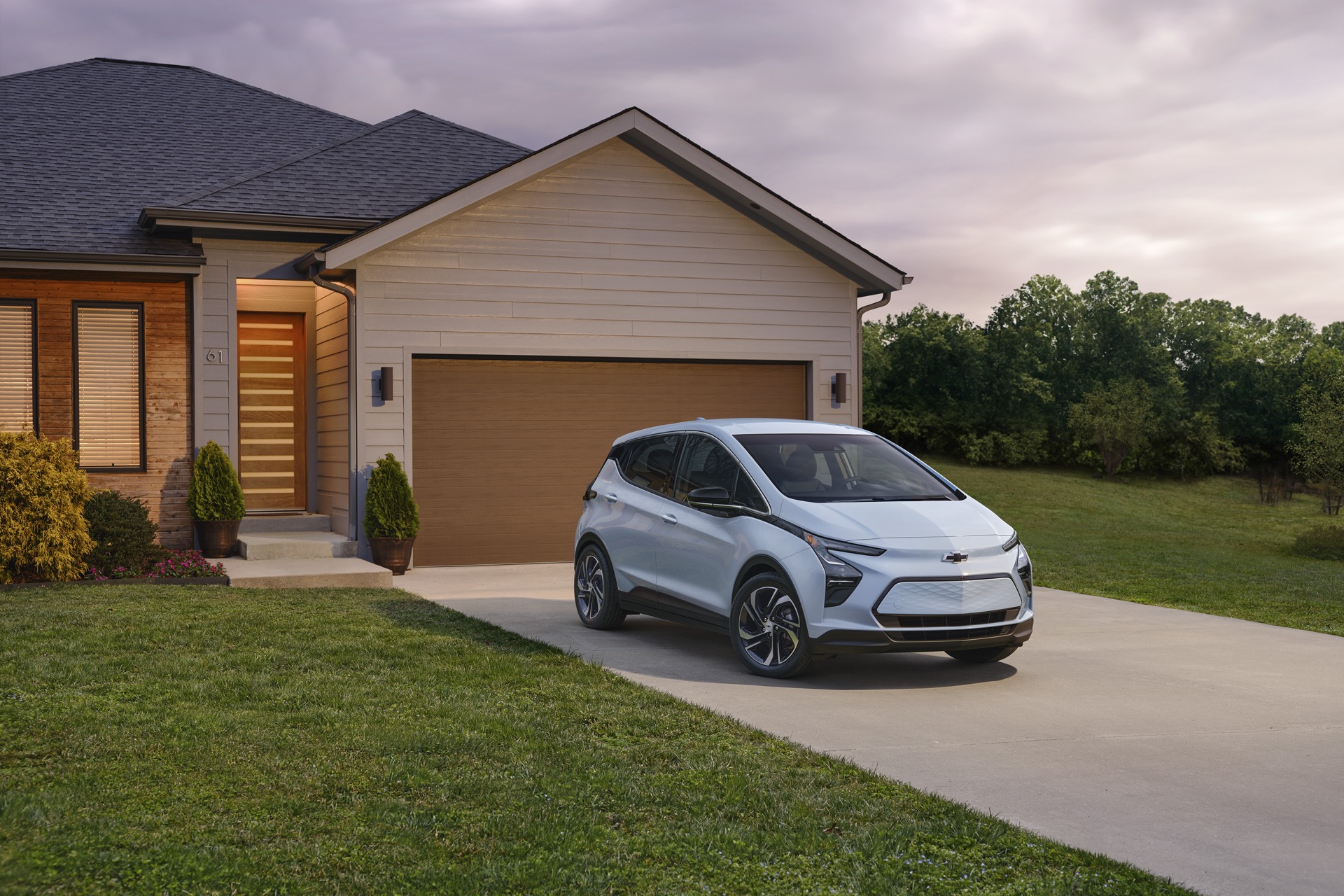

Models included are the 2022 Ford F Series electric pickup BMW X5 Nissan Leaf Chevrolet Bolt Jeep Wrangler plug-in hybrid. The Inflation Reduction Acts new credit immediately replaces the prior system and removes the 200000 limit but it creates new restrictions that are being phased in. Dan Kildee D-Flint Township that would eliminate the automaker cap on EV credits and implement a 7500 point-of-sale consumer rebate for electric.

Most of the Tesla models that were eligible for the tax credit cost from about 65000 to 140000. To receive the maximum 7500 credit the buyer would need sufficient taxable income first to reduce their tax bill by that amount leaving out many potential customers. But that could change.

EV Tax Credit Expansion.

Electric Vehicles Guide To Chinese Climate Policy

Us Senate Deal To Expand Ev Tax Credits Income Caps Price Caps

Ev Purchase Incentives Need To Shift To Point Of Sale Rebates

Should Congress Lift The 200 000 Sales Ev Tax Credit Cap Cleantechnica

Ev Tax Credit Extension With 7 500 Point Of Sale Rebate 4 000 For Used Evs Could Pass Senate Soon

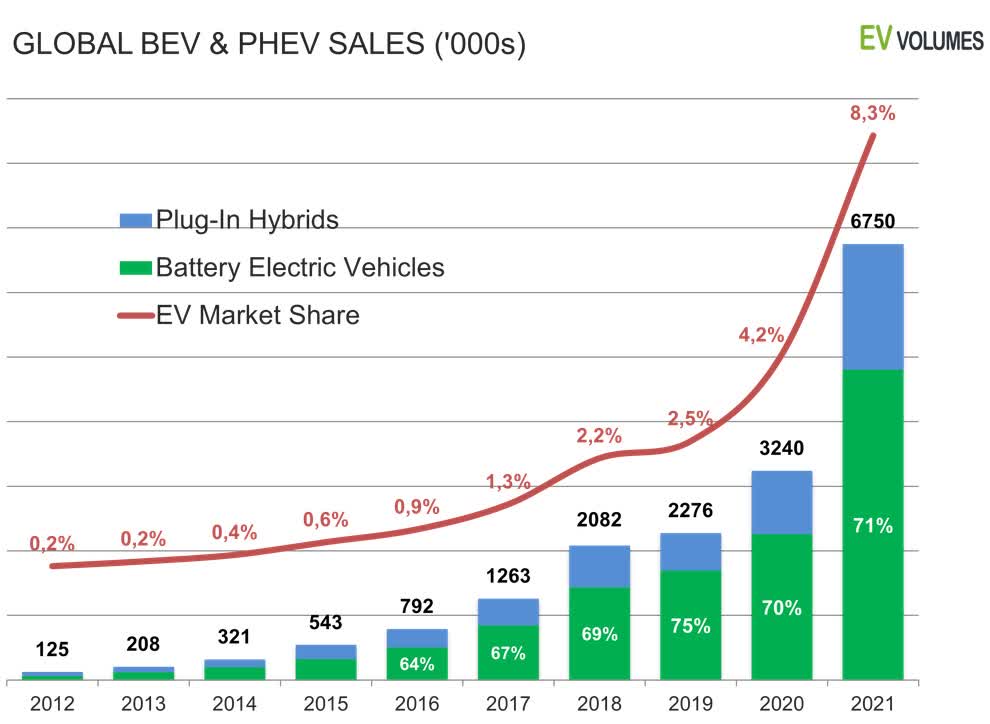

What To Expect In 2022 For Global Electric Vehicle Sales Seeking Alpha

Ev Tax Credit Extension With 7 500 Point Of Sale Rebate 4 000 For Used Evs Could Pass Senate Soon

Study Point Of Sale Ev Rebates Buyers Prefer Could Have Saved 2 Billion Vs Tax Credits

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

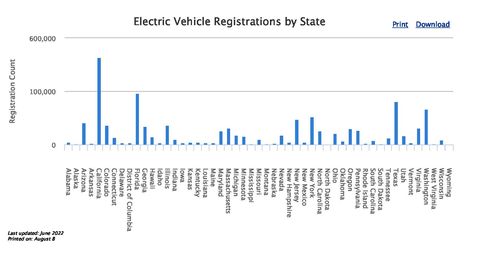

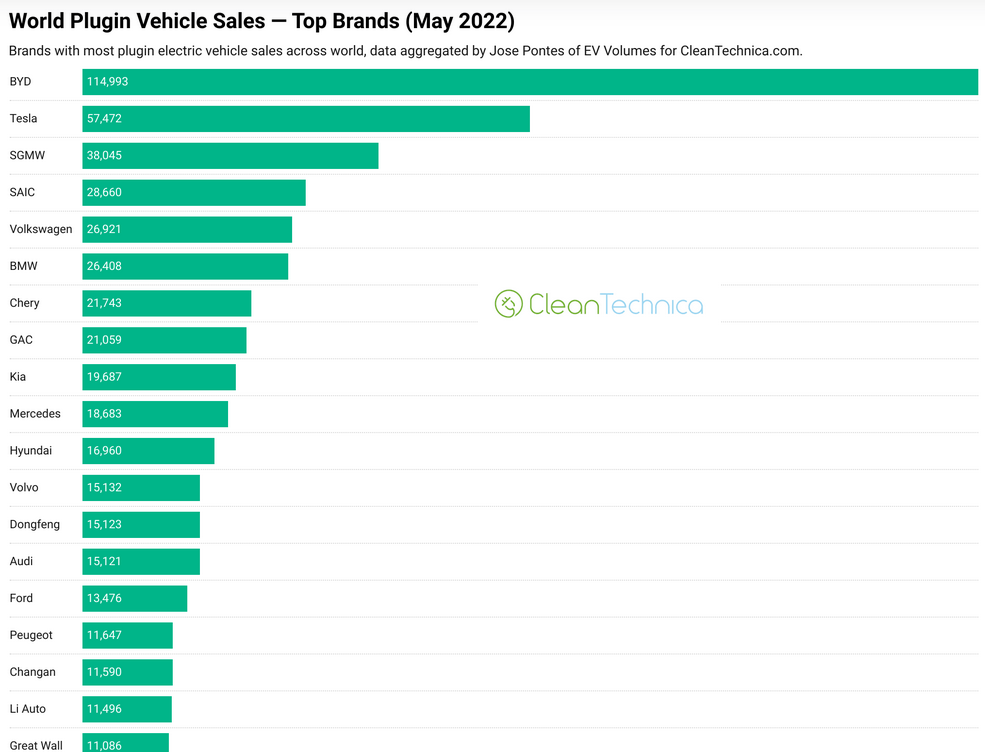

Ev Turning Point May Be Happening Sales Up 60

Us Ev Sales Tumble In 2020 But Ev Load Increases With More Charging Stations S P Global Commodity Insights

Us Senate Deal To Expand Ev Tax Credits Income Caps Price Caps

Ev Company News For The Month Of June 2022 Seeking Alpha

Senate Deal With Manchin Includes Ev Tax Credits Sought By Tesla Toyota Gm Bloomberg

Biden Aims To Juice Ev Sales But Would His Plan Work Ap News

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

Study Point Of Sale Ev Rebates Buyers Prefer Could Have Saved 2 Billion Vs Tax Credits

China S Ev Market Exploded In 2021 With A Record 3 Million Sales Protocol